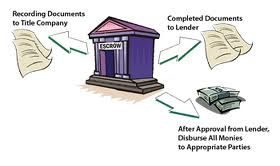

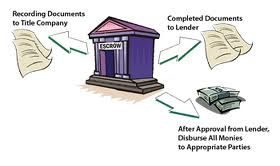

The Escrow Process

The definition of escrow, according to the dictionary is: A financial instrument held by a third party on behalf of the other two parties in a transaction. The funds are held by the escrow service until it receives the appropriate written or oral instructions or until obligations have been fulfilled. Securities, funds and other asses can be held in escrow.

At Synergy Escrow, we hold everyone accountable that involved in the transactions to do what they say and do what they are going to do. We are the gatekeepers from the beginning and the end of every escrow transaction. Once all conditions are met and everything is verified, the transfer of the title to the new owner is made, as well as the transfer of money to the buyer. Think of us as your guardian angels in the home transaction process.

The following are steps found in a typical escrow:

1. Prepare Escrow Instructions

2. Order Title Search

3. Request Demands and/or Beneficiary Statements

4. Accept Structural Pest Control Report and Other Reports

5. Accept new Loan Instructions and Documents

6. Accept Fire Insurance Policies and Complete Settlement

7. Request Closing Funds

8. Audit File in Preparation for Closing

9. Order Recording

10. Close Escrow

Whether you are buying a new home, refinancing or investing in property, Synergy Escrow can handle all of your escrow needs without fail.

Open an escrow with us by

Clicking Here